This Is The Lecture Of The Course

IFRS Kit

Lecture #3:

Understanding Foreign Currencies

Many companies develop foreign activities for many reasons and everything seems to be globalizing now.

It means that foreign activities of any company are more and more significant. And of course, financial statements of foreign businesses have become more important, too.

But here is the issue: Still, the world does not use a single currency. Instead, we have dollars, pounds, euros, crowns, rupees, yuans, yens, pesos, rubles, just name it.

Lot of foreign business out there

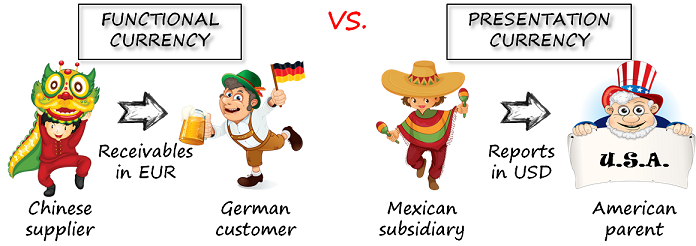

So just imagine a Chinese company who has some receivables towards a German company in EUR currency. How should this be translated to yuans?

Or let’s take something more advanced. Imagine an American company who has a subsidiary in Mexico. How will Americans prepare consolidated financial statements if they report in USD and the Mexican subsidiary in pesos?

Let’s take a look at standard IAS 21 The Effects of Changes in Foreign Exchange Rates, which gives us answers to all these questions.

You will learn 2 things here:

- How to translate foreign currency amounts to your functional currency (that’s our Chinese company with German receivables)

- How to translate a foreign operation’s financial statements to presentation currency (Mexican subsidiary of American company).

What is the difference between functional currency and presentation currency?

Functional currency is the currency of the primary economic environment in which the company operates. And, you need to translate all foreign currency amounts to your functional currency.

Presentation currency is the currency in which the financial statements are presented.

In many cases, functional and presentation currency are the same.

But in many cases they are not – for example, when a subsidiary needs to be consolidated with the parent in the parent’s functional currency.

How to determine functional currency?

You must be careful here! Functional currency is not necessarily the local currency of the country where the business is established. Let me give you an example:

ABC company has its seat and factory in China. ABC is primarily financed by the external loan in USD. ABC’s main activity is producing engines. ABC buys materials in USD and sells them in USD to its American customers. Wages, electricity and other local expenses are paid in Chinese yuans.

So guess what the functional currency of ABC is?

Yep, it’s probably USD, although the local currency is that of China. But selling price is quoted in USD, most material expenses are in USD – these are primary factors for determining functional currency.

So how do you translate foreign currency amounts to functional currency?

Let me give you a few basic steps:

- Determine your functional currency – we have just talked about it.

- Initially, translate all foreign currency amounts at the rate of exchange at the date of the transaction.

- At each subsequent closing date, you shall translate:

- all monetary items in foreign currency -> use closing exchange rate at the reporting date;

- non-monetary items in foreign currency carried at historical cost -> use historical exchange rate (at the date of transaction);

- non-monetary items in foreign currency carried at fair value -> use exchange rate at the date when fair value was determined.

- Recognize all exchange rate differences on monetary items in profit or loss (except for net investment in foreign operation, but let’s not complicate things here).

So now you should know how the Chinese company translates its receivables to the German company to its functional currency – yuans.

How to translate foreign operation’s financial statements to presentation currency?

Well, let me say why we do it: When you want to consolidate the parent’s and the subsidiary’s financial statements, they must be prepared in the same currency.

You just cannot aggregate EUR and USD amounts, could you?

So please remember the following rules:

- Assets (including goodwill) and liabilities -> use closing exchange rate of that balance sheet.

- Income and expenses -> use historical exchange rates (at the dates of transaction). You can use average rates for the period instead.

- Post-acquisition reserves, capital increases and dividends paid -> use historical exchange rates (at the dates of transaction).

- Share capital and share premium exchange rates -> use acquisition exchange rates (at the dates of acquisition).

- Recognize all exchange rate differences in other comprehensive income as a separate line. It is called “CTD” or currency translation difference.

Fine, so now, even translating a Mexican subsidiary’s financial statements in pesos to USD should not be a problem.

Or is it? OK, I know this topic could be a bit complicated. So please take a look to our video example here:

You can download the excel file with this example here.

Want to learn more? Check out IFRS Kit so you can learn IFRS quickly and end your IFRS struggles.