IFRS 9 Financial Instruments

Last update: July 2023

IFRS 9 Financial Instruments is one of the most challenging standards because it’s sooo complex and sometimes complicated.

It belongs to the “Big 3” – the three difficult standards that were significantly amended or newly issued in the past years:

- IFRS 9 Financial Instruments: adoption date = 1 January 2018

- IFRS 15 Revenues from Contracts with Customers = 1 January 2018

- IFRS 16 Leases = 1 January 2019

The trouble with IFRS 9 is that many accountants believe it does not affect them.

“We don’t have any financial instruments, we are a manufacturing company, so why should we care?”

Well, not so true.

At the moment you start selling on credit and issue invoices, you acquire the financial instruments – trade receivables. And yes, IFRS 9 applies here.

Therefore, no procrastinating, time to get ready!

In this article I summarize the main requirements of IFRS 9, but I don’t go into many details here – the purpose of this article is to give you the overview.

However, as I want to help you understand and smoothly implement IFRS 9, a few articles dealing with the specific topics were published on CPDbox – you can see their full list here.

If you enjoy the video learning more than reading, then please scroll down and watch the video with the summary of IFRS 9.

All set? Let’s start.

Why IFRS 9?

IFRS 9 establishes principles for the financial reporting of financial assets and financial liabilities.

Please note that:

- IFRS 9 does NOT define financial instruments. You can find the definitions of financial instruments in IAS 32 Financial Instruments: Presentation.

- IFRS 9 does NOT deal with your own (issued) equity instruments like your own shares, issued warrants, written options for equity, etc.

- IFRS 9 DOES deal with the equity instruments of someone else, because they are financial assets from your point of view.

- IFRS 9 does NOT deal with your investments in subsidiaries, associates and joint ventures (look to IFRS 10, IAS 28 and related).

When to recognize a financial instrument?

You should recognize a financial asset or a financial liability in the statement of financial position when the entity becomes a party to the contractual provisions of the instrument (please refer to IFRS 9 par. 3.1.1).

Unlike in other IFRS standards that put emphasis on the future economic benefits, IFRS 9 is more about the contract.

When to derecognize a financial instrument?

In other words, when to remove a financial instrument from your financial statements?

IFRS 9 treats the derecognition of financial assets differently from the derecognition of financial liabilities, so let’s break it down.

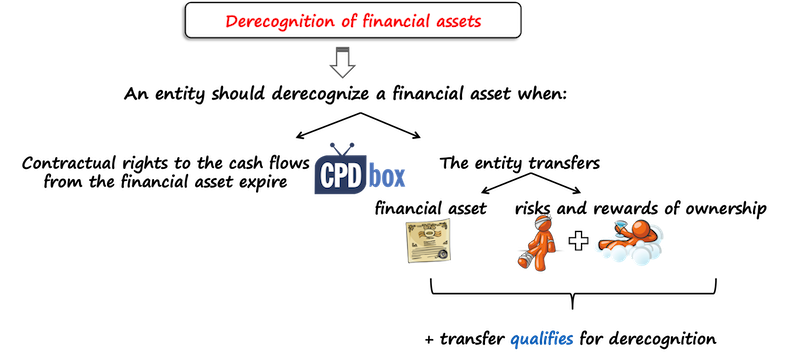

Derecognition of financial assets

While it’s very easy to recognize a financial asset, it’s very difficult and complicated to derecognize it in some cases.

IFRS 9 is very “sticky” and the reason is to prevent companies from hiding toxic assets out of their balance sheets.

Before you decide whether to derecognize or not, you need to determine WHAT you’re dealing with (IFRS 9 par. 3.2.2):

- A financial asset (or a group of similar financial assets) in its entirety, or

- A part of a financial asset (or a part of a group of similar financial assets) meeting specified conditions.

After you determine WHAT you derecognize, then you need derecognize the asset when (IFRS 9 par. 3.2.3):

- The contractual rights to the cash flows from the financial asset expire – that’s an easy and clear option; or

- An entity transfers the financial asset and the transfer qualifies for the derecognition – that’s more complicated.

Transfers of financial assets are discussed in more details and to sum it up, you need to go through the following steps:

- Decide whether the asset (or its part) was transferred or not,

- Determine whether also risks and rewards from the financial asset were transferred.

- If you have neither retained nor transferred substantially all of the risks and rewards of the asset, then you need to assess whether you have retained control of the asset or not.

Transfers of financial assets are then discussed in much greater detail in IFRS 9 and also, application guidance summarizes the derecognition steps in a simple decision tree. You can familiarize yourself with the decision tree in the video below this summary.

Derecognition of a financial liability

An entity shall derecognize a financial liability when it is extinguished.

It happens when the obligation specified in the contract is discharged, cancelled or expires.

Classification of financial instruments

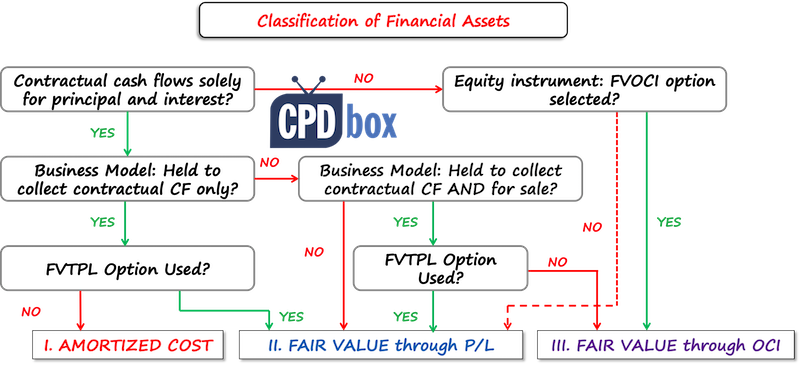

How to classify the financial assets?

IFRS 9 classifies financial assets based on two characteristics:

- Business model test

What is the objective of holding financial assets? Collecting the contractual cash flows? Selling? - Contractual cash flows’ characteristics test

Are the cash flows from the financial assets on the specified dates solely payments of principal and interest on the principal outstanding? Or, is there something else?

Based on these two tests, the financial assets can be classified in the following categories:

- At amortized cost

A financial asset falls into this category if BOTH of the following conditions are met:- Business model test is met, i.e. you hold the financial assets only to collect contractual cash flows (not to sell them), and

- Contractual cash flows’ characteristics test is met, i.e. the cash flows from the asset are only the payments of principal and interest.

Examples: debt securities, receivables, loans.

- At fair value through other comprehensive income (FVOCI)

Here, there are 2 subcategories:- 2a. If a financial asset meets contractual cash flows characteristics test (i.e. debt assets only) and the business model is to collect contractual cash flows AND SELL financial assets, then such an asset mandatorily falls into this category (unless FVTPL option is chosen; see below)

- 2b. You can voluntarily choose to measure some equity instruments at FVOCI. This is an irrevocable election at initial recognition.

- At fair value through profit or loss (FVTPL)

All other financial assets fall in this category.

Derivative financial assets are automatically classified at FVTPL.

Moreover, regardless above 2 categories, you may decide to designate the financial asset at fair value through profit or loss at its initial recognition.

The following scheme explains it:

How to classify financial liabilities?

IFRS 9 classifies financial liabilities as follows:

- Financial liabilities at fair value through profit or loss: these financial liabilities are subsequently measured at fair value and here, all derivatives belong.

- Other financial liabilities measured at amortized cost using the effective interest method.

IFRS 9 mentions separately some other types of financial liabilities measured in a different way, such as financial guarantee contracts and commitments to provide a loan at a below market interest rate, but here, we will deal with 2 main categories.

How to measure financial instruments?

Initial measurement

Financial asset or financial liability shall be initially measured at:

- Fair value: all financial instruments at fair value through profit or loss;

- Fair value plus transaction cost: all other financial instruments (at amortized cost or fair value through other comprehensive income).

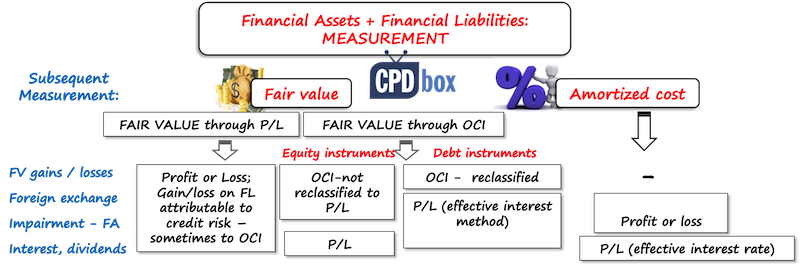

Subsequent measurement

Subsequent measurement depends on the category of a financial instrument and I think it’s self-explanatory according to the title of a category:

- Financial assets shall be subsequently measured either at fair value or at amortized cost;

- Financial liabilities are measured at amortized cost unless the fair value option is applied.

With regard to recognizing gains and losses from subsequent measurement, here’s the scheme for your convenience:

Impairment of financial assets

This is exactly the most important part for all of you who “have no financial instruments in their financial statements”.

Why?

Because, I explained above, even trade receivables are financial instruments.

Are you booking the bad debt provision?

So here you go.

Using the IFRS 9 terminology, “bad debt provision” = impairment of financial assets, or a loss allowance.

The new rules about the impairment of financial assets were added only in July 2014.

It does NOT affect all financial assets. For example, shares and other equity instruments are excluded, because their potential impairment is taken into account when re-measuring these investments to their fair value.

IFRS 9 requires entities to estimate and account for expected credit losses for all relevant financial assets (mostly debt securities, receivables including lease receivables, contract assets under IFRS 15, loans), starting from when they first acquire a financial instrument.

When measuring expected credit losses, entities will be required to use all relevant information that is available to them (without undue cost or effort).

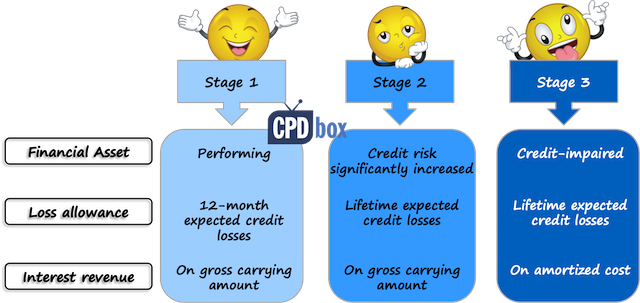

IFRS 9 offers two approaches:

- General model for measuring a loss allowance:

This model recognizes loss allowance depending on the stage in which the financial asset is. There are 3 stages:- Stage 1 – Performing assets: Loss allowance is recognized in the amount of 12-month expected credit loss;

- Stage 2 – Financial assets with significantly increased credit risk: Loss allowance is recognized in the amount of lifetime expected credit loss, and

- Stage 3 – Credit-impaired financial assets: Loss allowance is recognized in the amount of lifetime expected credit loss and interest revenue is recognized based on amortized cost.

- Simplified model:

You don’t need to determine the stage of a financial asset, because a loss allowance is recognized always at a lifetime expected credit loss.

You can read more about this model and the practical examples here.

If you subscribe to the free newsletter, you’ll receive an exclusive article with the video about the new impairment model.

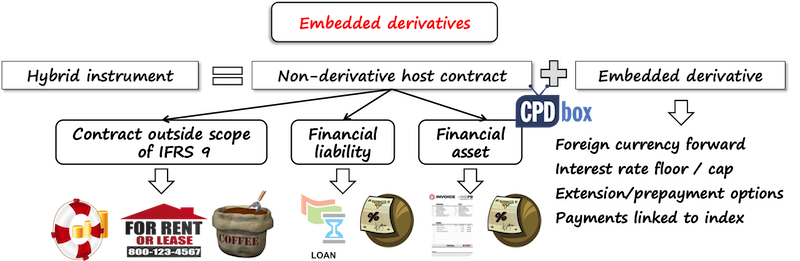

Embedded derivatives

An embedded derivative is simply a component of a hybrid instrument that also includes a non-derivative host contract.

Accounting of embedded derivatives depends on WHAT the host contract is:

- If host = financial asset within the scope of IFRS 9, then the whole hybrid contract shall be measured as one and not separated.

- If host = financial liability within the scope of IFRS 9 OR a contract outside the scope of IFRS 9 (e.g. service contract, lease contract…), then you should separate when the conditions are met.

If an entity is not able to do this, then the whole contract must be accounted for as a financial instrument at fair value through profit or loss.

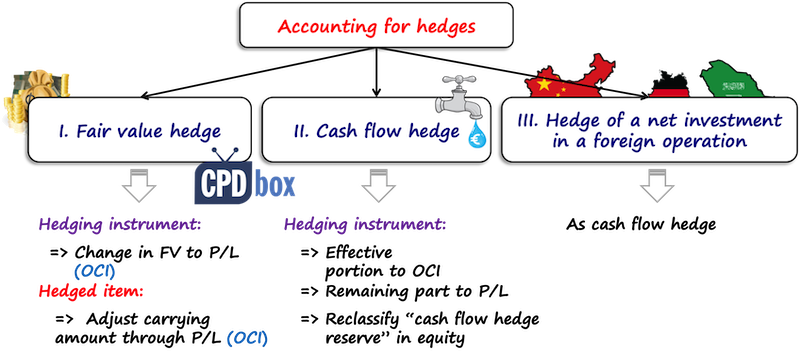

Hedge accounting

Hedge accounting is designating one or more hedging instruments so that their change in fair value is an offset to the change in fair value or cash flows of a hedged item.

If you’d like to see a simple illustration, please watch the video below this article (somewhere around the minute 17:43).

One very important remark:

Hedge accounting is NOT mandatory!

You do NOT have to do it, only if you want to (+meet the conditions).

Let’s say you try to protect your company against foreign currency risk and you enter into foreign currency forward contract. Even if you meet the conditions for the hedge accounting, you can still measure the derivative at fair value through profit or loss and not apply hedge accounting – up to you.

But, I strongly recommend reading the article about how ignoring hedging can hurt your business – maybe you’ll want to apply it voluntarily then.

If you want to apply hedge accounting, 3 criteria must be met (IFRS 9, par. 6.4.1):

- There are only eligible hedging instruments and eligible hedged items in the relationship;

- You have the hedge documentation at the inception of the hedge, in which you designate and describe your hedging,

- Hedge effectiveness criteria are met.

IFRS 9 sets the rules for 3 types of hedges:

- Cash flow hedge,

- Fair value hedge, and

- Hedge of the net investment in the foreign operation.

The overview of the accounting for these hedges is shown in the following scheme:

You can read more about hedging in one of our articles referred to below.

Further reading and video

To give you a helping hand in the understanding and application of IFRS 9, we published a few IFRS 9 related articles:

- How to Implement IFRS 9 (by Mr. Spark Wang Jun)

- How New Impairment Rules in IFRS 9 Affect You (by Silvia)

- How Ignoring Hedging Can Hurt Your Business (by Mr. James Philcox)

- Hedge Accounting: IAS 39 vs. IFRS 9 (by Silvia)

- Hedge Accounting Under IFRS 9: Rebalancing – What Is This New Concept? (by Mr. Kevin Mitchel and Silvia)

- Difference Between Fair Value Hedge and Cash Flow Hedge (by Silvia)

Here’s the video with the summary of IFRS 9:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

74 Comments

Leave a Reply Cancel reply

Recent Comments

- Refilwe on Our machines are fully depreciated, but we still use them! What shall we do?

- mekonnen on How to Account for Government Grants (IAS 20)

- Sewa PA System on How to account for intercompany loans under IFRS

- ASHAGRE TILAHUN TAYE on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Silvia on Example: IFRS 10 Disposal of Subsidiary

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Dear Silivia,

how would you derecognize financial liability for dividends due to extinguishment of debt (legally expired)? Through profit and loss or as capital contribution from owner?

Thank you in advance.

Kind regards,

TIbor

Do ECL calculation is dependent on related party transactions? If Company is compensated any related party loss through transfer Pricing and practically, we will never have any loss on related party. Should we consider risk factor as zero and no provision for same?

I have no words which might reward you for the efforts made through this video without being paid while i wana say thankyou very much for your best presentation in this complicated stadard.

Thank you 🙂

Dear Ms Silvia,

Is ECL or impairment be calculated for cash and cash equivalent, cash deposits at bank or cash balance at bank which is not restricted? The cash at bank which is used for daily deposits and daily expenditures…

Sincerely yours;

Wale Tilahun

+251911505215

Hi Silvia,

I have designated my equity instrument at FVTOCI. The changes in the fair value are presented in the OCI. Now, I sold such equity instrument. How to account for the sale transaction? As the difference between Cost Price and the Year end Fair Value are being reflected in the OCI Reserve till the Previous Year. On sale of such instrument, shall I account the changes in Previous Year end Fair Value and the selling rate to Profit or loss, or OCI? If I account for such in Profit or Loss, does the accounting mismatch not occur?

Please can anyone help me with an Excel spreadsheet template of computation of amortised cost & impairment for a portfolio of loan assets with varying tenors?

Yes Silva i was asking about the EAD as i am not sure how to calculate the EAD. Let me express what i got from your example: 12 months ECL for EAD we take the Cash Flow (CF) from next 12 month only to calculate the ECL right? so if the monthly CF is 100USD so that EAD for 12 month is 1200USD as we take 100USD* 12 months? M i correct?

No, that is not what I meant. You need to take the full exposure, not only the cash flows within the next 12 months. 12-month ECL takes into account probability of default within 12 months, this is true, but in case default happens within 12 months, you might not only lose those payments due in the next year, but ALL payments from that loan. So EAD is the amount due when the default happens (as the name “exposure at default” says).

Yes that’s why i confused the 12 months ECL and Life time ECL. Do you have any easy example for this? Thank you for your prompt response.

This portion is confusing me. What I understood is the same as what Vannthet understood. So what is it meant by “12-month ECL takes into account probability of default within 12 months”.

isn’t it 12 months expected cashflows

No Mohammed. It is rather probability that default occurs within 12 months. Practical example: you borrowed money to XY with the repayment date after 3 years. Now, let’s say that there is 10% chance that XY will go bankrupt within those 3 years – that’s life-time probability of default (for simplicity let’s assume that bankruptcy = default, which is not the case in reality). And, let’s say that there’s just 1% chance that XY will go bankrupt within the next 12 months because you see that XY is in a good shape and will hardly die out within the next 12 months – that’s 12-month probability of default. And then you are working with these probabilities to get relevant ECL. Let’s say that if XY defaults within 12 months, you will lose 80% of the money, so your 12-month ECL = probability of 1% * 80% * whatever XY owes you. Is that clearer?

Hi Silvia, could you help to explain more on how to calculate EAD for 12 months and life time with easy example? really appreciate your prompt response. Thank you.

EAD = exposure at default? That is how much you hold when your debtor goes bankrupt. Well that depends on the payment schedule of the loan/receivable. Usually, EAD is calculated as a remaining balance of the asset (e.g. receivable or loan) at the end of each period, but I have also seen different models. So for 12-month ECL, you are taking only remaining balance at the end of the next year (or what have you, depending on the model used), whereas for lifetime ECL, you need to incorporate EADs at the end of each reporting period until the end of the loan’s life.

Are you sure you were asking me about EAD and not PD?

We have a financial asset that is FVTPL and there is an associate transaction cost- is that just expensed during the same period as the purchase of the asset? Is there any impact to that if hedge accounting is implemented? I can’t find where in the standard it specifically talks about this.

Hi Sylvia, any practical application on how to calculate the interest revenue in stage 3 because a loan can sit in stage 3 anytime during the year so its hard to track the number of days the loan is sitting in stage 3. do you have any practical application examples as to how we can calculate this?

Hello S, Trust everything going well. Wanted to know is there any thing (Reconciliation, Coming Closer, Difference) IFRS 9 and FAS 30 (Islamic IFRS 9).

If we get something on it, will be great help,

Regards Abu

Hello S, Thanks for sharing insights on IFRSs specially 9,

Question please! Can we change business model from FVTPL to FVOCI or vice versa, if yes accounting and Financial statements impact please with Banking perspective!!

Hello, this is really broad question. You can change business model, but “FVTPL” and “FVOCI” are not business models, but the subsequent measurement methods. Also, FVTPL can be voluntary choice that is irrevocable – it is this case? Anyway, the answer to this question takes one long article, so thanks for pointing this out!

Thanks a million Dear S,

Waiting for detailed information, appreciate if get notification once it is available.

Also please confirm can we change subsequent measurement from FVTPL to FVOCI!! If yes what could be possible FS and accounting impact.

Appreciate your feedback

Hi Abu, yes, if you change the business model, it is possible to do this reclassification of a financial asset (not if you designated financial asset at FVTPL in line with IFRS 9.4.1.5 – that is irrevocable choice and not possible to do the reclass). In this case, you continue to measure your asset at fair value and you need to determine the effective interest rate as at the date of reclassification (as it would have been the initial recognition date) – see B5.6.2 of IFRS 9 for more info.

Many Thanks S.

Thank you for making understand this complex topic.You have made it possible for me to understand’

Hello Madam,

Can you elaborate on embedded derivative topic. It is too complex. I mean, a separate article on this topic. Please. I beg you.

Hi Sylvia,

I am working on company’s account. The Company has invested in Securities & Bonds. Kindly advise on the accounting for Bonds under IFRS 9.

Many thanks.

Best regards,

Ravindra RAMPHUL

Hi,

Refer IFRS 9, paragraph 6.5.2 (on types of hedge): If we enter into forward contract to hedge the foreign currency risk on loan denominated in foreign currency, the hedging does not falls into/ does not qualify for cash flow hedge, and we can only apply fair value hedge. Is my understanding correct? Thanks.

Well, I don’t think so. Please check this article for more guidance. S.

Dear Silvia,

my company holds government bonds measured at fair value through profit and loss in accordance with IAS 39. However, the bonds are held solely for payments of principal and interest, Should I continue to measure the bonds at fair value through profit and loss, or should I choose the amortized cost category under IFRS? Thanks!

Hi Jane,

IFRS 9 permits an option to voluntary measure any asset at FVTPL, so you can continue doing so.

Hi Silvia, Good day! Just one doubt. Will change in the loan interest rate constitute modification in the loan agreement as per IFRS 9?

Hello Silvia

Quick question on the disposal of investment in Subsidiary. If parent carries investment in Sub at fair value through OCI (election made on day 1), upon disposal of that sub, gains/ losses will not hit P&L . How about goodwill in the disposal computation? thanks

quick question on derecognition of financial liability i.e. accounts payable

on 31st dec, I write a cheque in the name of my supplier for 100$ that will be presented for collection on 5th of jan next year (period changes). question: should i derecognize liability on 31st dec as soon i write the cheque with the following accounting entry: Dr. accounts payable Cr. Bank. … (in fact, standard ERP applications do the accounting on 31st as soon as you pay some AP invoice).. What does IFRS say here?

Hi John, IFRS 9 says that you can derecognize a financial liability when it is extinguished (discharged, cancelled or expires). The question is at which point you may say that your financial liability is discharged. In practice, when you write a cheque and the bank blocks the cash on your account in favour of your supplier and you have no further right to that cash, I would say you can deem the liability discharged. S.

Thank you silvia. What the best business SME model

Hi

What is the effect of IFRS 9 on Pension Fund Company running a Defined Contribution Scheme.

Regards

Hi,

I would like to check if Redeemable preference Share can pass contractual cash flow characteristics’ test?

Redeemable preference Share in a private Company (unlisted), that will only redeem after 2 years. if yes can we consider it as Business model 2?

Hi Silvia thanks for the Articles, they have helped me in my Acca and I use them for reference at work most times.

however I have failed to solve this issue about a loan Payable that was transferred to some one else . How do I treat the transfer in the two different accounts

Hi,

I want to ask whether advances to employees are financial asset?

very useful article thanks a lot

Equity instruments which is designated in FVTOCI , why it cannot be used in Foreign ccy risk hedging

Hi Silvia, First of all, thanks for the valuable articles.

As IFRS 9 states, all financial assets and liabilities must be measured at fair value in initial recognition. In subsequent measurement, it is clear that the difference in AFS securities goes to Equity. But what about in initial recognition? So my question is that, the difference between fair value and the actual transaction price of AFS securities in initial recognition goes to equity (as OCI) or PL?

Hi Sylvia,

Great article. Just have a clarification. For equity instruments (not trading securities) classified under FVOCI, is cost still an acceptable basis for subsequent measurement under IFRS 9? Thanks in advance.

No.

Thanks Sylvia. What could be an appropriate basis of fair value for equity instruments (not trading securities) classified under FVOCI?

hey silvia i didnt find reclassification of financial asset concept

Hi Silvia,

Can you please advise whether we need to do ECL calculations on Inter Company Receivables (within Group) for IFRS 9 purposes?

Yes. And please see this article for further details.

Hi Silvia and all,

I have a quick question. We have sold some of our equity instruments at FVOCI during Q1 2018 and adopted IFRS 9. As a result, we have realized gain. Can we report that gain in OCI section of statement of comprehensive income instead of recycling it into P/L?

Thank you so much.

Hi Silvia, I want you to know that I have studied Hedge Accounting over and over again by reading my books over and over again but I still couldn’t get the point of it. Who would have thought that someone can explain it in a few seconds that I understand the concept now! YOU ARE AMAZING

Thank you, glad to help!

Hi Mary, great, I’m very happy to help!

Hi Silvia

I’m trying to establish the practical implementation of IFRS 9 regards the retrospective application thereof.

For example, based on calculations done in 2018, an entity has a profit or loss debit movement in provision for doubtful debt of CU2 000 (new IFRS 9 methodology). In 2019, the profit or loss movement is a debit of CU 500.

When adopting IFRS 9 in 2019, would the journals be (ignoring tax):

Dr Retained income 2 000

Cr Provision for doubtful debts 2 000

Dr Profit or loss 500

Cr Provision for doubtful debts 5 00

Could we call the movement in the Statement of Changes in Equity ‘Effects of retrospective implementation of IFRS 9’, and perhaps refer to the notes for more information?

Regards,

Tammy

How should investment in mutual funds should be classified ?

Hi dear silvia <3

up to this i got whatever you have written about IFRS 9 the only problem is that i have no idea about the amortised cost i mean how can we calculate amortised cost for a financial asset and liability.can you please help me out in this.

Thanks in advance

Hi, is cash advance of an employee subject for payroll deduction a financial assrt?

Basically yes, but it strongly depends what it does relate to. If it is related to the work performed during the month, it’s just non-monetary asset.

Hi, Silvia. I study IFRS 9 and watch your video with example 9 and 10 – derecognition of financial liabilities. Thanks to your clear explanation I understand how company accounts for modified agreement.

But what regarding bank? Bank keeps financial assets and continue to control it with modification in future payments. In both cases expl 9 and expl 10 bank must recognize P/L from modification p.5.4.3 IFRS 9.Does it mean that in expl 9: bank recognizes 4 416 977 – losses, expl : bank recognizes 10 6 078 000 – profit?

I hope on your advice. Thank you.

Dear Silvia,

Thank you very much for your interpretation. This is a excellent idea.

Thank you very much for your cooperation.

Best regards.

Hi Silvia,

Really great article. For basic bank facility loans can it be assumed the EIR would be the interest rate given by the bank or should it be benchmarked against the LIBOR?

Thank you

Davey,

thank you! It’s neither given by the bank, nor benchmarked against the LIBOR. You need to take all the cash flows resulting from the loan (including any fees that you paid) and calculate EIR yourself 🙂

Good afternoon, In calculating the EIR can one safely assume that the contractual interest rate is equal to the EIR if all the fees that you charge the customer upfront are accounted for under IFRS 15 as per Question 018?

No, that’s not the case, as some fees need to be included in the EIR calculation.

Hi Silvia

Thank you for such a nice Interpretation. Can you please give an example of Initial recognition at fair value and subsequent measurement at amortised cost using effective rate?

I would really appreciate that.

Adeel,

for example, loans at below market value. I brought the example in this article. S.

Good job Silvia. I usually refer IFRS box for easy implementation as we are 1st time adopters. Just for clarification, we(BANK) are expected to report our first IFRS report by June 2018, hence do your recommend early adoption of IFRS 9 instead of IAS 39 and IFRS 15 and 16 in our current situation?

Thank you for usual support.

Gadissa

Hi Gadissa,

that would be an excellent idea. There’s no point to wait until these standards come mandatorily into effect – you can apply them earlier and you will avoid restatements. S.

Thank you so much for sharing this wonderful article…For me IFRS-9 like horrow movie but after reading your arcticle and wactching your video..its look so easy…Thanks again.

Excellent work! thanks for sharing!

Congratulations Silvia, I must say that this was the most clear article I ever read about Financial Instruments and IFRS 9. Even in your articles before. I’m founding this subject (Financial Instruments) very difficult to understand, but this one I fully understood. So thank you very much, Silvia, you’re great!

Just one question: I have a bank guarantee imposed by a contract; and the bank imposed also, to give the guarantee, the subscription of a fund. In which category should fall this financial asset?

Thanks Silvia. In fact you’re my role model.

Wow, flattering, thank you! 🙂

Hi Sylvia

Thank you so much for your concise explanation.

Thank you for your very valuable effort in this regard

Hi Sylvia,

Thank you for your wonderful insights into understanding IFRS.

Please i need your advice on how to apply IAS 39 to a Non-performing loan. My company granted a short term loan to say company B in Foreign currency for a period of 6months with an interest rate of 10%. Company B has not been able to repay both the principal and interest since the loan was granted.

So we stopped charging interest to P or L 3 months after the loan default in 2015. Now we are about to close our books for 2016. Please how do we compute the impairment loss based on IAS 39.

Thank you.