Top 5 IFRS Changes Adopted in 2014

The year 2014 brought us some very significant changes in IFRS.

While some changes might not give you a hard time to adopt, the other changes can cost you a lot of money and time to make them effective in your company.

The year 2014 was rich in exactly these “revolutionary” changes that may require not only your own time to study the effect of amendments, but also system changes, business contract changes and maybe some careful implementation plan.

The first thing that you need: to be informed.

So let’s take a look what happened during the previous year and how you should prepare.

#1: New revenue recognition standard: IFRS 15 Revenue from Contracts with Customers

The question “WHEN to recognize revenue” belongs to one of the most controversial accounting issues today.

Of course, not every single company faces revenue recognition issues, especially when its business model is relatively simple.

However, in reality, almost everyone offers some incentives to attract new clients, just let me name a few examples:

- Buy one + get 1 free;

- Loyalty programs (in which, for example, you collect some points for regular purchases and then you get something for free or at discount);

- Sign up for 24 months of prepaid telecom plan and get the free or discounted handset;

And many others.

As the business develops and companies offer new products and types of services, it could be more and more difficult to recognize revenue correctly.

Before the change

As a result of increasing amount of transactions, several standards and interpretations were issued and each of them dealt with the revenue recognition under different circumstances:

- IAS 18 Revenue dealt with revenue recognition for sale of goods, rendering services and interest, royalties and dividends. There are separate rules for each of these situations.

- IAS 11 Construction contracts dealt with revenue recognition for contracts negotiated for construction of assets.

- A couple of interpretations, such as SIC 31, IFRIC 13, IFRIC 15 and IFRIC 18.

This situation was not very good, because different rules applied for different transactions and often, in some cases, the companies applied the same rules differently.

Therefore, there was a strong need to unify all these rules and bring one single framework for revenue recognition.

Now we have it. The long-awaited, new revenue recognition standard IFRS 15 Revenue from Contracts with Customers was issued in 2014.

After the change

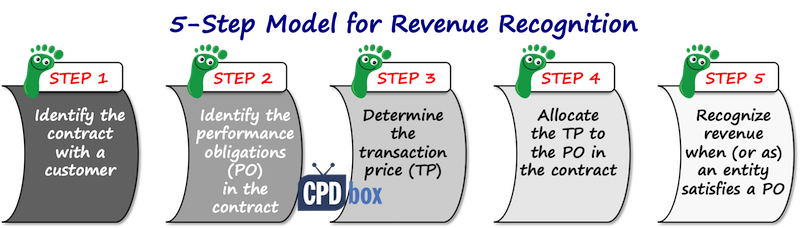

IFRS 15 introduces 5-step framework for revenue recognition:

We need to apply IFRS 15 for the periods starting 1 January 2017 or later, and all other revenue standards and interpretations will be superseded and no longer valid.

For some companies and businesses, the application of IFRS 15 may represent a huge system change that requires a lot of cash and time.

I wrote an article about the impact of IFRS 15 with the example of different treatment under IAS 18 and IFRS 15 – you can read it here.

#2: IFRS 9 Financial Instruments was completed!

The “old” standard IAS 39 Financial Instruments: Recognition and Measurement was considered so imperfect that the standard-setting organization, IASB, decided to replace it over time.

The plan was to issue completely new standard about the financial instruments. As financial instruments represent a very complex area, IASB decided to replace IAS 39 in stages, not at once.

Indeed, the whole replacement process took several years, with the first batch of new rules issued in 2009. Back then, the new standard got the reference “IFRS 9”.

Since 2009, IFRS 9 has been amended several times and the latest amendment came in July 2014.

What has changed?

New impairment rules: expected loss model

Little warning: please, don’t skip this paragraph if you think that the new impairment model does not affect you because you don’t work for the bank. It does affect non-financial companies, too.

Before the change, IAS 39 prescribed the “incurred loss model” which meant that you needed to recognize the impairment loss for a financial asset when the financial asset had already been impaired.

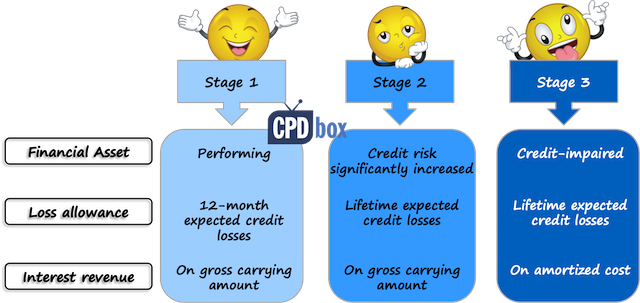

As opposed to that, IFRS 9 prescribes the “expected credit loss model”. It means that you should estimate and account for expected credit losses for all relevant financial assets starting from the point when you first lend money or invest in any other financial instrument.

In addition, when measuring expected credit losses, entities will be required to use all relevant information that is available to them (without undue cost or effort).

It means that under IFRS 9 you need to recognize loss allowance also for financial assets that haven’t been impaired yet.

The expected credit loss model differentiates 3 stages of financial asset’s performance, requires recognizing loss allowance according to asset’s stage and also, it prescribes simplified model for some types of financial assets.

The application of expected credit loss model requires entities, especially banks and financial institutions, to gather detailed information in order to estimate expected credit losses.

The whole model, with detailed explanations and numerical examples including stage by stage approach, simplified approach, collective assessment, etc. is covered in the IFRS Kit.

Also, you can read more about the new impairment model and its impact here.

Classification of financial instruments: new category introduced

Before the change, you could classify your debt financial instruments either as measured at amortized cost (if it met both business model test and contractual cash flow characteristics test), or at fair value through profit or loss.

The newest amendment introduced the third category for debt instruments: measured at fair value through other comprehensive income.

If your debt instrument meets contractual cash flow characteristics test (i.e. cash flows from instrument represent solely payments of principal and interest), and it is held under the business model whose objective is achieved by both collecting contractual cash flows AND selling, then it is classified at FVOCI (but you can still use FVTPL option).

When to apply new IFRS 9?

After some period of uncertainty, the effective date of IFRS 9 was set to 1 January 2018.

Therefore, you need to apply IFRS 9 in the current version for the periods starting on 1 January 2018 or later. Just let me remind you that you need to present comparatives under the new rules, so you need to incorporate new IFRS 9 rules for the comparative period starting 1 January 2017, too.

Now, what if you have decided to apply IFRS 9 earlier than from 2018 and you already use some older version of IFRS 9?

Those of you who use older versions of IFRS 9 (that is, without new impairment loss model, or even older versions) can continue in using these versions until 1 January 2018 without necessity to apply newest requirements.

But, if you plan to apply IFRS 9 earlier than in 2018 and you haven’t done that yet – be careful. For all periods starting 1 February 2015 or later, you need to apply complete IFRS 9 as amended in July 2014 – that is, with all the new impairment rules. You will not be able to apply older version of IFRS 9 after 1 February 2015.

The first 2 changes described above remind little “IFRS earthquakes” and fortunately, there were no more changes of the similar impact or importance.

Let me list a couple of other minor changes that you should be aware of.

#3: Amendments related to long-term assets (IAS 16, IAS 38, IAS 41)

During 2014, there were some minor changes related to long-term assets, but as every single company deals with long-term assets, let me list these amendments here:

Bearer plants

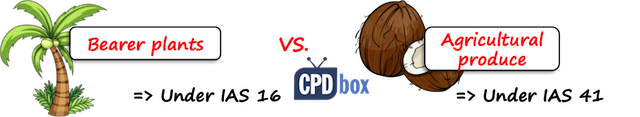

Bearer plants are simply plants used solely to grow produce and therefore, they were covered by the standard IAS 41 Agriculture as they were considered “biological assets”.

Examples: grape wines (but not the fruit grown on the grape wine); oil palms; apple trees, etc.

IAS 41 requires carrying biological assets at their fair value.

The experiences shown that the sense of carrying bearer plants at fair value was questionable, because bearer plants are usually used for more than 1 period, they do not transform biologically (they don’t grow) and they are used to produce some other assets.

The newest amendment in June 2014 permits treating bearer plants under IAS 16 Property, Plant and Equipment instead of under IAS 41 Agriculture.

Therefore, if this relates to your company, you can carry your bearer plants at cost less accumulated depreciation.

Depreciation and amortization method

Here, nothing much changed, as there was only a clarification of acceptable depreciation or amortization methods issued.

The clarification says that the revenue-based methods of depreciation are not acceptable, as they reflect “generation of economic benefits by the asset” and not “consumption of an asset”.

Example: you can depreciate your machine based on number of units produced by that machine. But you should not depreciate the same machine based on the revenues you expect to get from the sale of the produced units.

#4: IAS 27 Separate Financial Statements: Equity method permitted!

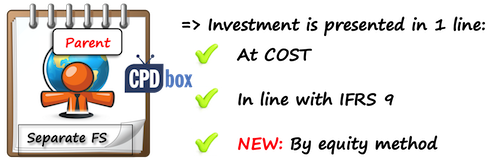

Before the change, IAS 27 permitted 2 methods of measuring the investments in subsidiaries, associates or joint ventures in the investor’s separate financial statements (not consolidated – here, other standards apply):

- At cost, or

- In accordance with IAS 39 Financial Instruments: Recognition and Measurement, or IFRS 9: Financial Instruments (whatever standard was applied by the investor).

However, the practices in some countries required the application of equity method for measuring these investments in the separate financial statements.

As a result, many companies needed to prepare 2 sets of financial statements: under local laws with the equity method applied, and under IFRS which did not permit the use of equity method.

The 2014 amendment of IAS 27 permitted the application of equity method for measuring the investments in subsidiaries, associates or joint ventures in investor’s separate financial statements, so currently, there are 3 options:

#5: New standard IFRS 14 Regulatory Deferral Accounts

When a new IFRS standard is issued, it’s always “a change”, therefore I mention the new IFRS 14 Regulatory Deferral Accounts here, in the list of the biggest IFRS changes in 2014.

However, the new standard will probably not affect many entities. The reason is that:

- You can apply IFRS 14 only on the initial adoption of IFRS – that is, when you prepare your IFRS financial statements for the first time.

So if you have already prepared IFRS financial statements before, you can forget about IFRS 14. - IFRS 14 relates only to regulatory deferral account balances.

What are regulatory deferral account balances?

Simply said, when a company provides services or sells goods at prices regulated by some regulator, then the rate regulation may defer the recovery of specified costs (or other amounts) through the prices charged to customers.

Typical examples are companies producing or selling electricity, gas and water.

These deferrals are usually kept in separate regulatory deferral accounts, although normally, you would charge them in profit or loss (as they do not meet the definition of an asset or liability).

IFRS 14 permits the first-time IFRS adopters to apply accounting policies under previous accounting rules for regulatory deferral accounts, i.e. entities do not need to select their IFRS accounting policies. It is an exemption from applying IAS 8.

However, it is a temporary solution, until IASB completes comprehensive project on rate regulated activities.

Other changes and amendments in 2014

Except for the changes and amendments described above, here’s the list of other minor changes that may affect you and you should be aware of:

- IAS 19 Employee Benefits:

The amendment clarifies how to determine a discount rate for post-employment benefits. The corporate bonds used in estimating the discount rate should be in the same currency as the benefits paid. - IAS 28 Investments in Associates and Joint Ventures and IFRS 10 Consolidated Financial Statements:

The amendment addresses the issue of sale or contribution of assets between an investor and its associate and joint venture. - IAS 34 Interim Financial Reporting:

The amendment clarifies the meaning of “elsewhere in the interim report”. - IFRS 5 Non-current Assets Held for Sale and Discontinued Operations:

The amendment specifies the reporting of changes in methods of disposals (reclassification of an asset from held for sale to held for distribution or the opposite way, discontinuing of held-for-distribution accounting). - IFRS 7 Financial Instruments: Disclosures

The amendments add clarifications to servicing contracts and deals with disclosures in the condensed financial statements. - IFRS 11 Joint Arrangements

The amendment adds the rules for accounting for acquisition of interests in joint operations when joint operation constitutes a business.

Here’s the video with the top 5 changes in IFRS adopted in 2014:

If you like this article and the video, please share it with your friends and leave me a comment below. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

11 Comments

Leave a Reply Cancel reply

Recent Comments

- Refilwe on Our machines are fully depreciated, but we still use them! What shall we do?

- mekonnen on How to Account for Government Grants (IAS 20)

- Sewa PA System on How to account for intercompany loans under IFRS

- ASHAGRE TILAHUN TAYE on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Silvia on Example: IFRS 10 Disposal of Subsidiary

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

very goog video and good information. thank you

Dear Madam

Thanks for the efforts , all the contents are interesting

I’m working in KSA and from 01/01/2017 the IFRS,s will be implemented for Joint stock entities

I appreciated if you could give more attention for IFRS1 ( first time adoption)

Dear Madam,

Do you have INDIA specific program?

kindly inform.

Thanks!

Dear Rajkumar,

I should visit India on March 14-15, 2015 to participate on the International IFRS Conference in Hyderabad (however, the details haven’t been finalized yet). I will have a speech there, but currently, I don’t plan any specific training there.

I will lead 2-days of technical update training in April in Malaysia. However, if there’s someone from India who would like to organize it with me, then I would do it. 🙂

Dear Silvia,

Kindly thanks for share this info

Have a nice 2015

Lots of hugs

Thank you 🙂

Thank you. Very informative

Dear Silvia,

Thanks for all the hardwork and very informative article.

Regards,

Suman Kumar.K

A very helpful update. Thanks.

Really helpful summary for the latest amendments in IFRS.

We kindly thank you in advance for your kind information and support.