How to account for contracts to buy commodities with future delivery (own use)?

To make sure that producer get deliveries of certain materials or products on time, they enter into the commodity contracts with the future delivery.

That is fine, but if there are clauses like “fixed price”, “net cash settlement option”, “future delivery date”, then we, accountants, shall watch out.

The reason is that is smells like a commodity derivative and it is NOT accounted for as simple purchase of inventories under IAS 2; instead – IFRS 9 applies.

Today’s question asked by Lee from Canada relates exactly to this issue:

“Our company produces metal products and we buy lots of raw materials, like lead, nickel, copper iron. We often enter into contracts for future delivery, for example, to purchase 10 tons of nickel with delivery in 6 months.

The price is usually fixed, but sometimes there’s a clause that if we don’t actually need the physical delivery, we can opt to pay or receive the difference between agreed price and the current market price of nickel in cash.

Also, our CFO was worried about constant movement of raw metal prices and started to hedge them with purchases of commodity forwards.

How can we account for this type of the contract?”

Answer: It depends.

Excellent question.

OK, normally, you should account for similar contracts as for purchases of inventory, that’s clear.

But sometimes, there’s derivative inside the contract.

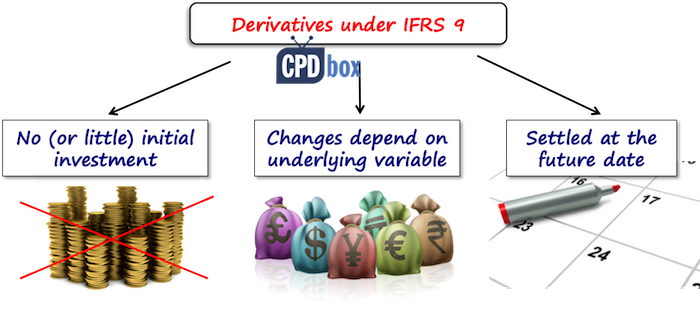

It meets all three conditions:

- There is no initial investment,

- The contract is based on an underlying variable which is the price of nickel this time, and

- It will be settled in the future date.

Therefore in this case, the contract is a commodity derivative – it’s a forward contract to purchase nickel.

The important question is:

Should you account for this contract as for derivative? Should you apply IFRS 9?

It depends.

IFRS 9 says, more specifically in paragraph 2.5, that you have to apply IFRS 9 for all contracts to buy or sell a non-financial item that can be settled net in cash or in another financial instruments.

So this would mean that yes, you have to account for this order of nickel in question as for a derivative, because the contract said that the buyer can settle the difference between agreed price and market price in cash.

In this case, you need to remeasure the commodity forward to its fair value at each reporting date and recognize the change in profit or loss.

But luckily, IFRS 9 continues:

The exception are contracts that were entered into and continue to be held for the purpose of the receipt of the non-financial item in accordance with the entity’s expected purchase, sale or usage requirements.

In other words – IFRS 9 does not apply to so-called “own-use” contracts.

In this case, you could simply say that yes, we are buying nickel in the future to make our metal products, we are going to take nickel, so now we don’t need to book it as a derivative, just as simple order contract when nickel is delivered.

The main idea is to produce and therefore, the changes in fair value do not affect us.

Fair enough.

Here, you need to be careful about one thing.

I stress that in order to apply regular purchase accounting for own-use contracts, the contract must truly be for own use, just normal purchase or sale.

Why am I saying that?

When the contract in NOT for own use

It can happen and normally happens, that the contract is NOT an own use contract, despite the fact it is described as such.

Let me list a few examples of such a situation:

- If there’s a possibility of net cash settlement in the contract and the past practice shows that the contracts are often settled in cash. That could indicate that the contracts are not own use.

- Or, you would normally enter into offsetting contract with the same counterparty. Let’s say you have a contract to buy nickel and you enter into the contract to sell nickel with the same entity – that’s net settlement, too.

- Or, you take the nickel or the delivery of other item and you immediately or within some short time sell it to make profit. So you’re not using the commodity for own use, but for making profits.

All these circumstances indicate that the contract is not for own use and therefore, you must account for it as for the derivative.

Example: Own-use contract vs. derivative contract accounting

On 1 November 20X1 ABC made an order to buy 2 tons of nickel for CU 30 000 with physical delivery on 31 January 20X2.

Similar nickel forward contracts with delivery on 31 January 20X2 were offered at the strike price of CU 30 600 as at 31 December.

The spot price of nickel is CU 15 500 per ton on 31 January 20X2.

Own-use contract accounting:

If ABC assesses that the contract is for own use (please see the conditions above), then no accounting is required at 31 December 20X1.

On 31 January 20X2, when the delivery is taken and invoice received, ABC makes journal entry:

- Debit Inventories of nickel: CU 30 000

- Credit Suppliers: CU 30 000

Derivative contract accounting

If ABC assesses that the contract not for own use, or simply decides to account for this contract as at fair value through profit or loss (see below), then the change in fair value must be recognized in profit or loss at the reporting date.

For the sake of simplicity, let’s calculate the fair value of the commodity derivative as the difference between the strike price on 31 December 20X1 of 30 600 and the agreed strike price of 30 000, which is CU 600.

At the end of December, the change in fair value is accounted for as:

- Debit Derivative assets: CU 600

- Credit Profit or loss – change in fair value of derivatives: CU 600

At the end of January, we have three things to take care about:

- Fair value change of a commodity derivative:

FV change is calculated as a difference between the spot price of CU 31 000 (15 500*2) and the previous fair value of 30 600, which is CU 400.

The journal entry is:- Debit Derivative assets: CU 400

- Credit Profit or loss – change in fair value of derivatives: CU 400

- Physical delivery of inventories at agreed price of CU 30 000:

- Debit Inventories of nickel: CU 30 000

- Credit Suppliers: CU 30 000

- Settlement of a derivative with physical delivery:

- Debit Inventories of nickel: CU 1 000

- Credit Derivative assets: CU 1 000

Own-use contracts and hedge accounting

Today’s question is really excellent because there’s one more thing – let me copy that part again:

“Also, our CFO was worried about constant movement of raw metal prices and started to hedge them with purchases of commodity forwards.”

OK, so you have the price risk here and you want to hedge it .

But, in this case, you would need to meet the hedge accounting criteria, and test hedge effectiveness, which is quite a burden, so there’s another way.

You can decide to designate the own use contract at fair value through profit or loss at initial recognition – not later.

Why would you do that?

Well, if you hedge similar contracts with derivatives and you do not apply the hedge accounting, then you would have the accounting mismatch.

The reason is that you would revalue your derivatives via profit or loss, but NOT the own use contract.

So you would see just one-sided profit or loss and that’s not what you want.

Instead, you would designate the own use contract at fair value through profit or loss and you will reach the automatic natural offsetting of profit from own use contract with loss on hedging instrument – derivative or vice versa.

To sum it up – if you want to hedge the price risk in your own-use contracts, you have 2 options:

- You apply the hedge accounting, but in this case, there’s additional administrative burden,

- You designate the own-use contract at the inception as at FVTPL and the offset or hedging is reached naturally.

Here’s the video summing this all up:

Any comments or questions? Please let me know below. Thanks!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

17 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on How to Account for Decommissioning Provision under IFRS

- Silvia on What is the lease term of cancellable property rental contracts under IFRS 16?

- James Carter on How to Account for Decommissioning Provision under IFRS

- Moses Felix on IAS 16 Property, Plant and Equipment – summary

- Moses Felix on Summary of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

I have been using IFRS box since my university days. I am now in my 2nd year of articles (one board exam away from qualifying) and i am still using IFRS box. I want to sincerely thank you for your ability to explain IFRS in a manner that is understandable.

CPDbox 🙂 and thank you!

Hello

Why would you hedge the price risk in your own-use contract if the delivery price is already fixed and known from the beginning (CU 30 000 in the example) ?

Thank you very much.

Hi Silvia, Thanks for this very helpful article. Can I just check something in your example as it is causing some confusion. In the derivative accounting section where you detail the double entry as :

(3) Settlement of a derivative with physical delivery:

Debit Inventories of nickel: CU 1 000

Credit Derivative assets: CU 1 000

I believe the debit to “Inventories of nickel ” should actually be posted as a “debit to”Profit or loss – change in fair value of derivatives, as the settlement of derivative should have no bearing on the Inventory cost. The inventory valuation should be in line with the purchase cost, which in your e.g. should be CU30,000.

This should also be therefore in line with the IFRIC guidance issued in March 2019 for own use assets.

Would very much appreciate if you could clarify or otherwise shed more light. Also am assuming the PL impact is classified as other income and expense in the P&L?

Thank you very much.

Hello, Hassan.

Thank for your opinion. Actually, I think also like that. It is just a bit of confusion by increasing the inventory value. If there is a physical delivery you can’t write such a kind of double entry. It can only happen in the net cash settlement action.

Hi Silvia

Greetings from Ethiopia and thank you very much for the videos and notes on IFRS, they are really helpful !

My company is adopting IFRS for the first time in 2019 and currently i am trying to prepare an opening and comparative statements. the line of buisness for the company is in is a manufacturing firm and there are lots of inventory movements. My question relates to effect of depreciation to ending inventory (finished goods and work in progress). As a first time adopter the depreciation amount under the new IFRS is way less than the GAAP depreciation and we need to adjust for the over depreciation of PPE

do you think i should go back and adjust the inventory values by the proportion of decrease in depreciation (for those itesm whose depreciation goes to the COGS) even though the items are currently sold ?

thank you very much

Hi Silvia,

I am involved in international trade. We sell goods to export markets mostly to countries in APAC region. Most cases our selling term is EXW (Ex-works Incoterm 2010) However at times we do sell based on CIF (Cost Insurance & Freight) and FOB (Free on Board) basis.

May I check when should we consider revenue recognized based on our sales terms/inco term?.

Hi Siliva,

My company trades in commodities. If they have bought let’s say 25 MT of aluminium for $6030/MT (96.5% purity) and if they are not able locate the customer for this commodity immediately, they’ll sell it to the broker (trading in LME) for $6061 (100% purity) for 3 months as per OTC Forward Contract. Let’s suppose they were able to locate customer within next 3 months for $6246.50 (98% purity) then they’ll purchase the aluminum back from the broker for $6244 (100% purity). Now in this case hedged item will will the inventories (commodities) and the hedging instrument will be Forward contracts.

Now here,

Hedged Item : Physical Sale $6246*98%= $6121 subtract Physical Purchases $6030*96.5%=$5818 gives a profit of $302

Hedged Instrument : Hedged Sale $6061 Subtract Hedged purchase $6244 gives a loss of $183.

I shall be obliged if you could assist me the accounting of such a transaction.

Regards,

Deepali

Hi Silvia,

I am really impressed in how all of it become clear and simple one you explained it.

I have some questions though:

1) In my case, we use the “own-use” exemption for our energy commodities with future Delivery. However, we are expecting this year to buy settle our positions in the market in ordre to realize a profit. The “own-use” expention shoudl’nt be appliable then. Does it mean that for every new future contrat, it should be considered as a derivative ? Is there any chance to get back the “own-use” exemption for new contracts. I can’t find any precise answer in IFRS 9.

2) We do not recognize inventories one the physical Delivery occurs. We book directly an operationnel expense. Based on your example, should my journal entry for settlement be as follows ?

◦Debit Operationnal exepense: CU 1 000

◦Credit Derivative assets: CU 1 000

Thank you very much for your answers

Best regards

Dear Silivia,

I am really pleased with the way IFRS box has aided my IFRS learning. Well I just have a query as regards the definition of a Derivative as per IFRS is concerned. Going by the definition of Derivative as per IFRS – 9, Prepaid Interest Rate (Fixed rate payment obligation prepaid at the inception where in we prepay fixed and receive variable interest as per LIBOR) is regarded as a derivative contract, whereas a contract of Prepaid pay variable & receive fixed interest rate swap is not regarded as a derivative contract citing ‘No Initial Investment required’ condition. I would be glad if you could please elaborate on the second part which is not considered as a derivative contract.

Dear Rakesh,

thanks a lot for your kind words. Please, I need to keep the comments and the website tidy and your question is off topic – not related to contracts to buy commodities with future delivery. If you’d like to get your question answered and you believe that my answer could help other readers, too, then please submit it via contact form and I’ll try to cover it. Thank you!

Thanks a lot Silivia,

Really your IFRS Box is the best place for learning and understanding the IFRS & IAS. Thanks for effort and your smooth explanation,

My personal experiment that I was facing difficulty to go through the IFRS’s books and trying to understand and applying its text. But after IFRS’s Box the things became more easier and interesting.

Really its a great contribution from your side to make many professionals started to go through the standards and its application.

Dear Hemdan,

thank you so much for your kind words. I really appreciate it as I know that you are my long-term subscriber to both free materials and the IFRS Kit, too. All the best!

This is super great Silvia.

Hi, may I know how to designate own use contract as FVTPL at initial recognition as the first entry we made for the own use contract is DR Inventory CR Bank

Hi Hazel,

you did this entry when the actual inventory was delivered. At that time, it is indeed inventory and there is nothing to designate. I was talking about the contracts for the delivery of inventory IN THE FUTURE. Let’s say it’s May 2018 and you order inventory at the fixed price with delivery in October 2018. In May 2018, you can designate this contract at FVTPL (derivative) as you cannot account for this contract Dr Inventory Credit Bank (there was no delivery and no payment yet). I hope it’s clearer now 🙂

hi silvia, then what is the double entry for FVTPL ?