How to Account for Government Grants (IAS 20)

Almost every government supports certain companies or business by providing grants or other kind of assistance.

As this is clear benefit and advantage comparing with other companies without such an assistance, it should be properly reported in the financial statements.

How?

Let’s explain the rules and then solve a simple example.

What do the rules say?

The most important standard dealing with government grants is IAS 20 Accounting for government grants and disclosure of government assistance.

It’s quite an old standard – it was issued in 1983 with the effective date from 1 January 1984 and there were no significant changes from that day.

The main objective of IAS 20 is to prescribe the accounting for and the disclosure of

- The government grants – simply speaking, these are the actual resources, whether monetary or non-monetary, transferred to an entity by a government, in most cases upon completion of some conditions;

- The government assistance – these are other actions of the government designed to provide some economic benefit to an entity, for example free marketing or business advices.

IAS 20 deals with almost all types of government grants, with the following exclusions:

- Government assistance in the form of tax reliefs (tax breaks, tax holidays, etc.),

- Grants related to agriculture under IAS 41;

- Grants in the financial statements that reflect the effect of changing prices and

- Government acting as a part-owner of the entity.

How to Account for Government Grants

Before we dig a bit more in details, let me stress that you should never ever credit the receipt of any grant directly in equity.

This capital approach is not permitted in IFRS.

Instead, IFRS prescribe so-called “income approach” – to recognize grants as income over the relevant periods to match them with the related expenditures or costs they should compensate.

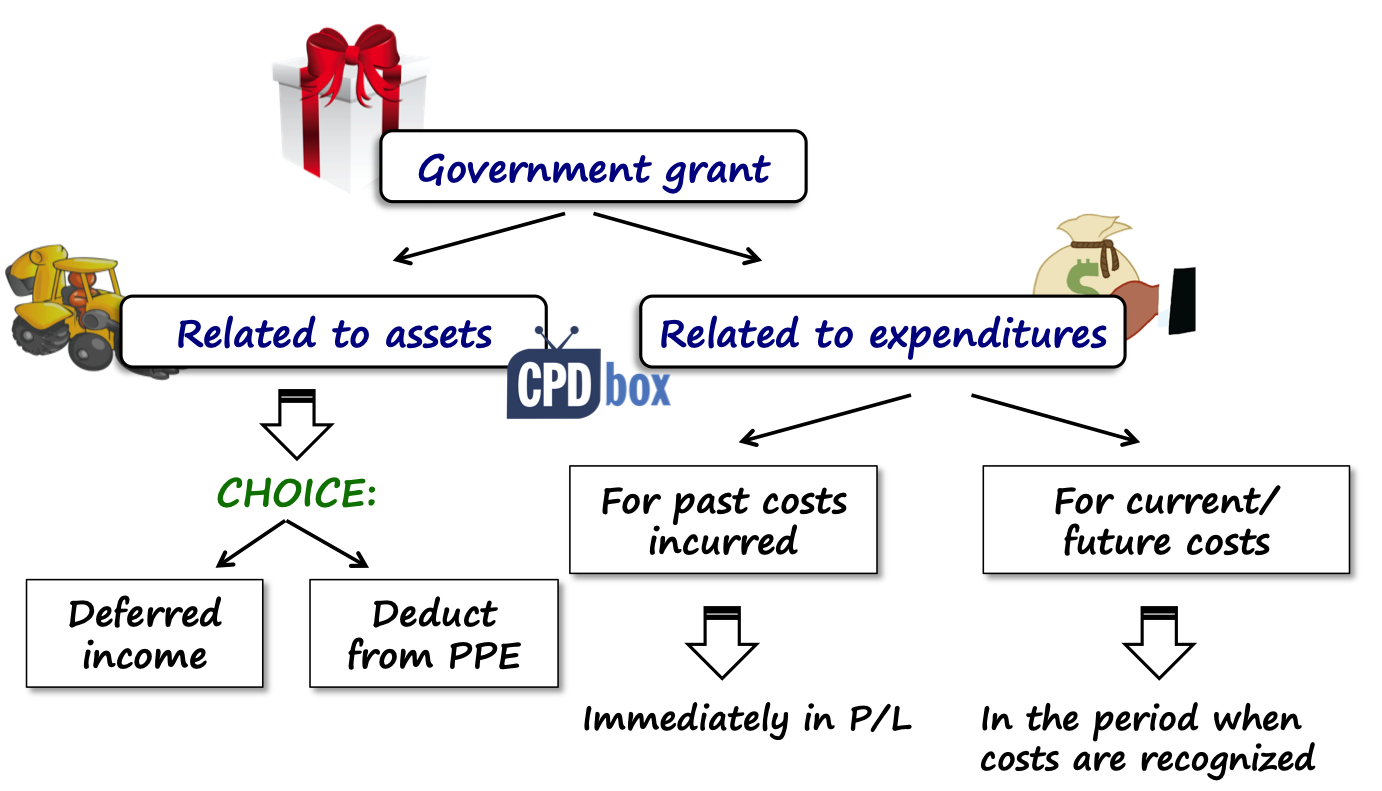

Specific accounting treatment depends on the purpose of the grant received. An entity can receive a grant either for:

- Acquisition of an asset, or

- Reimbursement of costs.

Grant related to assets

If an entity receives the grant for acquisition of some assets, there are 2 options to present such grant in the financial statements:

- To present it as deferred income; or

- To deduct the grant from the carrying amount of an asset acquired.

In the example below, I show you both options.

Grant related to income (reimbursement of expenditures)

Here, you need to differentiate between the grants for past costs (already incurred) or the grants for current or future costs.

If the grant is provided to reimburse costs incurred in the past, then it is recognized immediately in profit or loss.

If the grant is provided to reimburse costs incurred or to be incurred at the present time or in the future, then the grant is recognized in profit or loss in the periods when the costs are incurred.

From the presentation point of view, there are 2 options:

- To present the grant income as a separate line item as “other income”, or

- To deduct the grant income from the related expense.

Let me illustrate it on a short example:

Government grants – question:

ABC receives the following government grants in 20X2:

- Grant of CU 40 000 to acquire a water cleaning station. The cost of the station was CU 100 000 and its useful life is 8 years. ABC acquired the station on 1 July 20X2 and recognized depreciation on a straight-line monthly basis.

- Grant of CU 10 000 to cover the expenses for ecological measures during 20X2 – 20X5. ABC assumes to spend CU 3 000 in 20X2-20X5 and CU 2 000 in 20X6 (CU 14 000 in total).

- Grant of CU 3 000 to cover the expenses for ecological measures made by ABC in 20X0-20X1.

Prepare the journal entries in the year ended 31 December 20X2.

Government grants – solution:

As there are 3 different grants, let’s solve them one by one.

Grant for a water cleaning station

This grant is a typical grant to acquire property, plant and equipment. As written above, we have 2 choices to present it:

Option #1: Deferred income

ABC can credit the grant to deferred income and amortize it over the useful life of a water cleaning station in order to match the grant income with the relevant costs (in this case depreciation charges).

In 20X2, ABC recognizes CU 2 500 in profit or loss (calculated as the grant of CU 40 000 divided by 8 years times 6 monhts in 20X2 divided by 12 months in a year).

Our journal entries are:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 40 000 | SoFP – Cash/Bank account | SoFP – Deferred income |

| Recognition in P/L in 20X2 | 2 500 (40 000/8*6/12) | SoFP – Deferred income | P/L – Income from government grant |

Option #2: Deduction from an asset

ABC can deduct the grant amount to arrive at carrying amount of a water cleaning station. Then its recognition in profit or loss is automatically reflected in depreciation charges.

As a result, the new carrying amount of a water cleaning station upon initial recognition is CU 60 000 (cost of CU 100 000 less grant of CU 40 000) and the annual depreciation charge is CU 7 500 (CU 60 000 divided by 8) instead of CU 12 500 (CU 100 000 divided by 8). In the first year, it’s CU 3 750 (6 months only).

Our journal entries are:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 40 000 | SoFP – Cash/Bank account | SoFP – PPE (Water cleaning station) |

| Recognition in P/L in 20X2 (within depreciation charge) | 3 750 (60 000/8*6/12) | P/L – Depreciation of water cleaning station | SoFP – PPE (water cleaning station) |

Note: SoFP = statement of financial position.

Grant for ecological measures in 20X2-20X5

Apparently, the second grant is provided to reimburse the expenses for ecological measures in 20X2 to 20X5. In other words, it is a grant for current and future expenses.

ABC needs to recognize the income from grant in the periods when relevant expenses are incurred.

In this example, we can calculate the portion recognized in P/L in 20X2 on a proportionate basis, i.e. assumed CU 3 000 in 20X2 divided by total assumed expenses of CU 14 000 times the grant of CU 10 000.

The credit entry goes in profit or loss, but here, ABC has a choice to present the grant income as a separate line item (that’s easier) or to deduct it from the expenses.

The journal entries are:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 10 000 | SoFP – Cash/Bank account | SoFP – Deferred income |

| Recognition in P/L in 20X2 | 2 143 (3 000/14 000*10 000) | SoFP – Deferred income | P/L – Income from grants (or relevant expense) |

Grant for ecological measures in 20X0-20X1

The third grand relates to the expenses that had already been incurred in the previous years 20X0 and 20X1.

As a result, the grant is recognized immediately in profit or loss.

The journal entry is:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 3 000 | SoFP – Cash/Bank account | P/L – Income from government grant |

You can watch a video about accounting for government grants here:

In my next article, I will try to clarify the biggest issues arising around government grants, so if you have any specific question, just leave me a comment and stay tuned! I’ll be happy if you share this article with your friends, thanks a lot!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Srđan on Accounting for Deemed Disposal of Associate (IAS 28)

- Silvia on How to Account for Decommissioning Provision under IFRS

- Silvia on What is the lease term of cancellable property rental contracts under IFRS 16?

- James Carter on How to Account for Decommissioning Provision under IFRS

- Moses Felix on IAS 16 Property, Plant and Equipment – summary

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

If government gives land for one of its enterprise for free and the enterprise constructs a building n it and starts operation. How does this land grant recorded?

PLEASE GIVE ME A GOVERNMENT GRANT DISCLOSURE REAL LIFE EXAMPLE IAS-20

Government Grant received for one of the projects with Government in construction industry subject to pay minimum wages QAR 1,000 to blue collar worker, what will be the double entry of Govt. Grant related to the Project. I want to mention here also the cost has already incurred.

Hi Silvia,

If an organisation receive a grant from Government and construct a capital asset. It capitalises capital asset in its fixed assets register. But same time it impairs it as it is a loss making business. Should grant income be recognised in same year of impairment or should it be recognise over the life of the asset?

Please advise